Page 7 - State-of-the-Industry-2013

P. 7

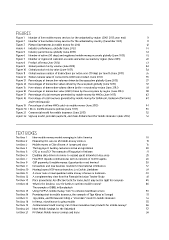

FiGUreS

Figure 1 Number of live mobile money services for the unbanked by region (2001-2013; year-end) 9

Figure 2 Number of live mobile money services for the unbanked by country (December 2013) 11

Figure 3 Planned investments in mobile money for 2014 12

Figure 4 Industry performance, globally (June 2012) 14

Figure 5 Industry performance, globally (June 2013) 14

Figure 6 Number of active (90 days) and registered mobile money accounts globally (June 2013) 19

Figure 7 Number of registered customer accounts and active accounts by region (June 2013) 22

Figure 8 Product ofering (June 2013) 33

Figure 9 Global product mix by volume (June 2013) 34

Figure 10 Global product mix by value (June 2013) 34

Figure 11 Global average number of transactions per active user (30 day) per month (June 2013) 35

Figure 12 Global average value of transactions (USD) per product (June 2013) 35

Figure 13 Percentages of transaction volumes driven by the ecosystem globally (June 2013) 37

Figure 14 Percentages of transaction values driven by the ecosystem globally (June 2013) 37

Figure 15 Percentages of transaction volume driven by the ecosystem by region (June 2013) 38

Figure 16 Percentages of transaction value (USD) driven by the ecosystem by region (June 2013) 38

Figure 17 Percentage of total revenues generated by mobile money for MNOs (June 2013) 43

Figure 18 Percentage of total revenues generated by mobile money for Safaricom, Vodacom (Tanzania) 43

and MTN (Uganda)

Figure 19 Percentage of airtime MNOs sold via mobile money (June 2013) 44

Figure 20 Life vs. nonlife insurance policies (June 2013) 50

Figure 21 Commercial model for mobile insurance (June 2013) 52

Figure 22 Sign-up model, premium payment, and claim disbursement for mobile insurance (June 2013) 52

text boxeS

Text box 1 New mobile money models emerging in Latin America 10

Text box 2 Measuring the success of mobile money services 13

Text box 3 Mobile money in Côte d’Ivoire: A turnaround story 15

Text box 4 The big payof: Getting customers active at registration 20

Text box 5 OTC or not OTC? The example of Easypaisa in Pakistan 21

Text box 6 Enabling data-driven decisions to expand agent networks in key areas 25

Text box 7 How MTN Uganda communicates with its network of 15,000 agents 26

Text box 8 G2P payments & mobile money: Opportunity or red herring? 30

Text box 9 Innovations and new business models for international remittances 32

Text box 10 Moving beyond P2P money transfers: EcoCash in Zimbabwe 39

Text box 11 A closer look at interoperable mobile money schemes in Indonesia 40

Text box 12 A complementary view from the Financial Inclusion Tracker Study 41

Text box 13 Price promotions: An efective tactic for some, but it may not be right for everyone 45

Text box 14 What is the business case for banks to get into mobile money? 46

The example of DBBL in Bangladesh

Text box 15 Using M-PESA mobile money “rails” to enhance healthcare access 50

Text box 16 Promising start in mobile insurance, the example of Tigo Kiiray in Senegal 51

Text box 17 Tigo, Bima, and MicroEnsure bring a “Freemium” model to mobile insurance 53

Text box 18 In Kenya, microfnance is going mobile 55

Text box 19 Airtime-based credit scoring: Can it drive innovative loan products for mobile money? 56

Text box 20 Next: Mobile Savings for the Unbanked 57

Text box 21 M-Shwari: Mobile money savings and loans 58