Page 22 - State-of-the-Industry-2013

P. 22

State OF the induStry 2013

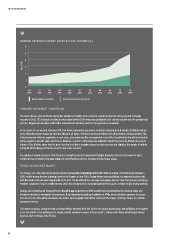

NUMBER OF MOBILE MONEy USERS IN CôTE D’IVOIRE [6]

6

5

4

millions 3

2

1

0

q4 q1 q2 q3 q4 q1 q2 q3 q4 q1 q2

2010 2011 2011 2011 2011 2012 2012 2012 2012 2013 2013

registered accounts active accounts (90 days)

CHANGES IN MARKET CONDITIONS

The most obvious external factor driving the adoption of mobile money was the country’s return to civil peace and economic

recovery in 2012. [7] A decade of political crisis culminated in 2010 when two candidates both claimed to have won the presidential

election, triggering a national confict that weakened the economy and left the population vulnerable.

In the course of one week in February 2011, four banks suspended operations, creating a major money shortage. [8] Public distrust

of the fnancial system deepened, and was aimed at all types of fnancial service providers, including mobile money providers. The

limited presence of banks, especially in rural areas, also made liquidity management more difcult and limited the ability of mobile

money agents to provide cash-out services. However, a return to civil peace has helped to restart the economy. Mobile money pro-

viders in Côte d’Ivoire agree that the post-election crisis had a negative impact on their services and attribute the uptake of mobile

money in 2012 in large part to the country’s economic recovery.

The uptake of mobile money in Côte d’Ivoire is not just the result of newfound stability, however. Over the last couple of years,

mobile money providers have been using new and efective tactics to increase mobile money usage.

FOCUS ON ORANGE MONEy

For Orange, one of the key factors driving success has been the commitment of its Ceo. With the arrival of CEO Mamadou Bamba in

2010, mobile money became a strategic service for Orange. In June 2010, Orange Money was established as a separate business unit,

with the head of the unit reporting directly to the CEO. The benefts of this new approach quickly became clear: the business unit sharp-

ened the company’s focus on mobile money, which has proven to be an essential ingredient for success in other mobile money markets.

Orange also strengthened Orange Money’s brand image by partnering with established companies like the national water and

electricity utilities to administer bill payments. It also invested in building a network of ATMs, which allowed customers to access

cash at any time without the assistance of a mobile money agent. This further reinforced the image of Orange Money as a reliable

and secure service.

“On many occasions, customers told us Orange Money changed their life. In fact the various partnerships and initiatives we engaged

in are the results of our willingness to simply provide adequate answers to their needs”, Sadamoudou Kaba, Head Orange Money

Business Unit at Orange Côte d’Ivoire

16