Page 21 - State-of-the-Industry-2013

P. 21

Part 1 - mOBile mOney

TexT BOx 3

mobile moneY in côte D’ivoire: a turnarounD storY*

after a challenging start, mobile money is taking of in Côte d’ivoire. In June 2013, CelPaid, Moov, MTN, Orange, and Qash Services

together registered close to 5 million mobile money accounts, 35% of which are active. [1] It is quite an impressive number consider-

ing there are only 9.6m unique mobile subscribers in Côte d’Ivoire (the mobile market has 20.1m GSM connections and a high degree

of multi-SIMing). [2] However, it is only recently that Ivoirians have started to adopt mobile money. In December 2011, three years

after the launch of the country’s frst mobile money service, there were just over 2 million registered accounts and 22% were active.

What external factors have driven the adoption of mobile money in Côte d’Ivoire? What tactics have mobile money operators

employed to increase usage?

The story of mobile money in Côte d’Ivoire demonstrates that mobile money can be successful even in markets where it struggled

initially, and that it is possible for a slow-growing mobile money service to become a sprinter. [3]

BACKGROUND

At frst glance, the opportunity for mobile money in Côte d’Ivoire seems huge. With a population of 19.8m and the highest GDP

per capita in the region, it has one of the most dynamic economies in West Africa. [4] In addition, with only 10.7% of adults in Côte

d’Ivoire having access to a formal fnancial institution [5], mobile money seems an obvious conduit to increase fnancial inclusion.

Early on, the Central Bank of West African States (BCEAO) realised that mobile money had the potential to signifcantly increase

fnancial inclusion. In 2006, the BCEAO issued regulation on electronic money that qualifed non-banks for an e-money issuer

license. Under this regulation, an e-money issuer can be a bank (in partnership with an MNO) or a non-bank institution that has been

granted a specifc licence by the central bank.

Since this regulation was issued, fve companies launched their mobile money service in Côte d’Ivoire: Orange, MTN and Moov (the three

leading MNOs in the country, licensed through their partner banks), and CelPaid and Qash Services (two non-bank e-money issuers).

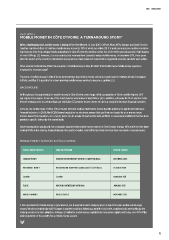

MOBILE MONEy SERVICES IN CôTE D’IVOIRE

Mobile Money ServiCe ServiCe provider date of launCh

OranGe mOney OranGe in PartnerShiP With BiCiCi (BnP PariBaS) deCemBer 2008

mtn mOBile mOney mtn in PartnerShiP With SGBCi (SOCiété Générale) OCtOBer 2009

CelPaid CelPaid FeBruary 2011

FlOOz mOOv in PartnerShiP With BiaO january 2013

mOBile BanKinG QaSh ServiCeS nOvemBer 2013

It has taken time for mobile money to gain traction, but it seemed to reach a tipping point in mid-2012 when mobile wallet usage

soared. What was behind this shift? Changes in market conditions following a period of civil strife, combined with new tactics by the

leading providers to drive adoption. As Figure 2 illustrates, mobile money registrations have grown rapidly and today, over 40% of the

adult population of the country has a mobile money account.

15