Page 7 - index

P. 7

7

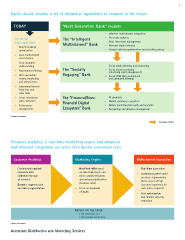

Banks should consider a set of distinctive capabilities to compete in the future

TODAY “Next Generation Bank” models

− Effective multichannel integration

The “Do the The “Intelligent − Pervasive analytics

basics right” Bank Multichannel” Bank − Real-time event management

− Branch network − Personal digital advisory

optimization − Product offering optimization and scientific pricing

− Basic multichannel

orchestration

− Deep customer

understanding − Social media listening and monitoring

− Need-based offerings The “Socially − Social digital marketing

(clustering client engagement)

− Web and mobile Engaging” Bank − Social CRM (data enrichment

channel marketing and optimized offering)

and effectiveness

− Empowered branch

front-line and

sales tools

− Smart interaction The “Financial/Non- − M-payments

with customers Financial Digital − Mobile commerce ecosystem

− Performance − Mobile marketing M-loyalty and analytics

management Ecosystem” Bank − Partnership and alliances management

Source: Accenture

Possible Paths

Pervasive analytics, a real-time marketing engine and advanced

multichannel integration can more than double conversion rates

Customer Analytics Marketing Engine Multichannel Interaction

− Continuously updated − Next best offer based − Real-time proposition

customer data on real-time inputs and − Customized paths based

collection through micro-segment features on micro-segmentation

all channels and actions prioritization (focus on pre-design

− Dynamic segmentation (business rules) customer experience for

and micro segmentation − Focus on moments each micro-segment)

of truth

− Cost optimization

and channel capacity

evaluation

MONEY ON THE TABLE

− x 2/3 conversion rates

− x 2/3 customer interactions

Source: Accenture

Accenture Distribution and Marketing Services

Banks should consider a set of distinctive capabilities to compete in the future

TODAY “Next Generation Bank” models

− Effective multichannel integration

The “Do the The “Intelligent − Pervasive analytics

basics right” Bank Multichannel” Bank − Real-time event management

− Branch network − Personal digital advisory

optimization − Product offering optimization and scientific pricing

− Basic multichannel

orchestration

− Deep customer

understanding − Social media listening and monitoring

− Need-based offerings The “Socially − Social digital marketing

(clustering client engagement)

− Web and mobile Engaging” Bank − Social CRM (data enrichment

channel marketing and optimized offering)

and effectiveness

− Empowered branch

front-line and

sales tools

− Smart interaction The “Financial/Non- − M-payments

with customers Financial Digital − Mobile commerce ecosystem

− Performance − Mobile marketing M-loyalty and analytics

management Ecosystem” Bank − Partnership and alliances management

Source: Accenture

Possible Paths

Pervasive analytics, a real-time marketing engine and advanced

multichannel integration can more than double conversion rates

Customer Analytics Marketing Engine Multichannel Interaction

− Continuously updated − Next best offer based − Real-time proposition

customer data on real-time inputs and − Customized paths based

collection through micro-segment features on micro-segmentation

all channels and actions prioritization (focus on pre-design

− Dynamic segmentation (business rules) customer experience for

and micro segmentation − Focus on moments each micro-segment)

of truth

− Cost optimization

and channel capacity

evaluation

MONEY ON THE TABLE

− x 2/3 conversion rates

− x 2/3 customer interactions

Source: Accenture

Accenture Distribution and Marketing Services