ICT spending in Saudi Arabia is set to grow at a compound annual growth rate (CAGR) of 9.2% between 2019 and 2024, to reach US$46.6bn, according to GlobalData.

The growth in ICT spending will be primarily driven by increased spending by enterprises in client computing and cloud computing technologies during the forecast period. Together, these leading IT solutions will account for 38% of the overall ICT market revenue in 2024.

Kaipa Shashank, Senior Technology Analyst at GlobalData, says: “Client computing will continue to occupy a major revenue share of the overall ICT market in Saudi Arabia during the forecast period. Growth can be majorly attributed to the advent of 5G devices, as the market has finally stabilized after the upheaval caused by domestic policy and regulatory changes which impacted consumer spending in the country.”

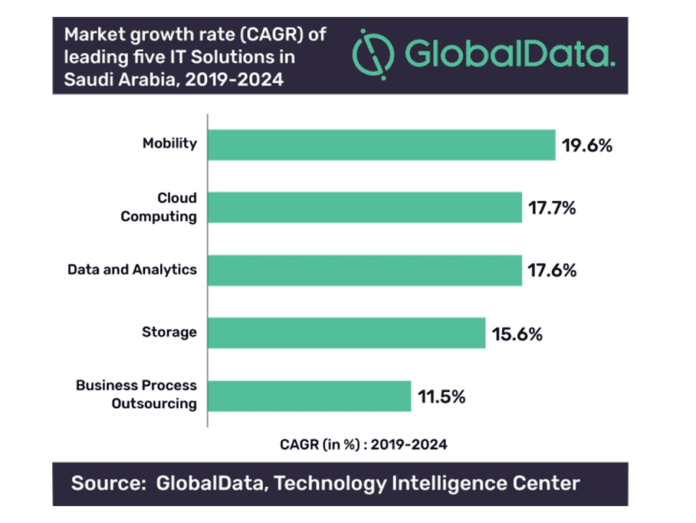

Mobility will witness the highest growth rate of 19.6%, driven by the need for improved connectivity through advanced next-generation wireless networks.

Shashank adds: “The rapid adoption of digital technologies is in line with the government’s ‘Saudi Vision 2030’ plan to digitalize the country’s economy from oil dependence, and will further fuel the need for high-speed connectivity solutions across various industries.”

Cloud computing will follow mobility as the second fastest-growing segment at a CAGR of 17.7% during the forecast period, to reach US$7.7bn by 2024.

Shashank says: “Increasing adoption of cloud based services by public and private sectors for their computing needs, along with country’s cloud-first policy, announced in 2019, which encourages the public sector migration from legacy solutions to cloud based solutions will contribute to cloud computing’s growth.”

Energy and manufacturing will be the two major verticals, together accounting for 60.4% of the overall ICT revenue in 2024. The energy sector is expected to continue to invest in ICT technologies for digital transformation, despite complications arising due to OPEC compliances, terror attacks on oil facilities and increased oil production cuts. Similarly, growth in manufacturing is expected to be driven by a focus on enhancing productivity and reducing operational costs through the adoption of digital technologies.

Shashank concludes: “Political stability in the Kingdom and significant revenues from oil reserves has meant that Saudi Arabia has historically been one of the strongest economies in the Middle East region. The government’s bid to reduce the economy’s oil dependence and undertake infrastructure modernization efforts means that ICT investments will grow across both the public and private sectors.

“In the next three years, organizations will be more inclined towards investing in digital technologies such as artificial intelligence (AI), Internet of Things (IoT), cloud and mobility to modernize their infrastructures and increase their revenues. However, the lack of skilled labor will continue to pose a challenge for the growth of the overall ICT market in Saudi Arabia.”