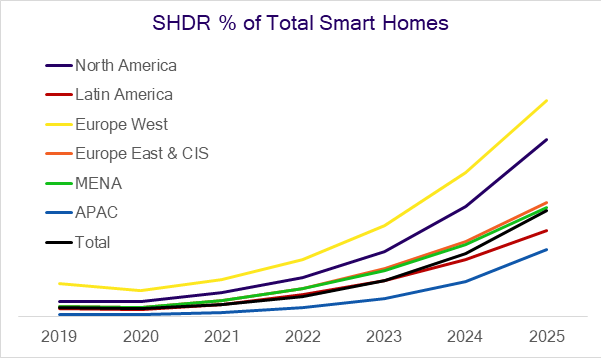

Rethink Technology Research has found that by 2025, over 212 million homes globally will be participants in utility demand response programs, accounting for $466 billion in electricity spending and 366 GW of electricity usage, according to rethinkresearch.biz. However, the utility-controlled share of this market will slide from 98% to 76%, as third-party providers leverage smart home technologies to become valuable partners to the energy providers.

Within five years, over 28 million homes globally will be using smart home technologies to participate in these third-party demand response (DR) programs – around 23.74% of the total number of DR homes. These smart home based DR homes (SHDR) account for nearly 3% of total global households, 16% of total global smart homes, and almost 24% of total DR homes.

This means that the utilities move from controlling around 98% of DR homes today to 76% in this period, as a plethora of startups and smart home vendors begin to take hold of the Residential DR opportunities (RDR). This report is focused on the RDR market, distinct from grid-scale and Industrial & Commercial (I&C) DR.

The other interesting trend in this sector is the adoption of Home Energy Management Systems (HEMS), which consist of a battery installed in the home, and the technology needed to integrate this battery with the main grid – so that it can participate in DR programs, or act as a store for rooftop solar. We anticipate HEMS adoption to reach 2.75 million homes in 2025, representing some $24.6 billion in potential annual revenue—high value, if niche.

These two trends represent a huge amount of energy that could be leveraged by utilities. The total amount of RDR homes is projected to account for 366 GW of energy annually in 2025, or 3.2 million GWh – representing $465.9 billion spent on electricity at market rates. The subset of SHDR homes will represent 86.9 GW, 761,942 GWh, and $110.6 billion respectively, while homes with HEMS systems will represent 22.43 GW of energy usage annually, or 196,594 GWh.

IoT technologies are the primary enablers for DR, and in time, will enable much more advanced use cases, such as scheduling white goods appliances or EV charging, instead of simply turning down the HVAC usage. Smart metering is a piece of the DR puzzle, but these meters are not requirements for participation. With rooftop solar still growing, HEMS providers will enjoy strong cross-selling opportunities, and homes with batteries and their own generation capacity could be some of the most valuable DR assets for utilities that are looking to leverage DR.

An upcoming forecast will tackle Industrial and Commercial (I&C) DR. Collectively, both DR approaches go a long way towards solving the headaches that come with integrating distributed energy resources (DERs). The variable generation output of DERs can be accommodated by adjusting the demand-side load of the utility customers, treating them as an aggregated battery.

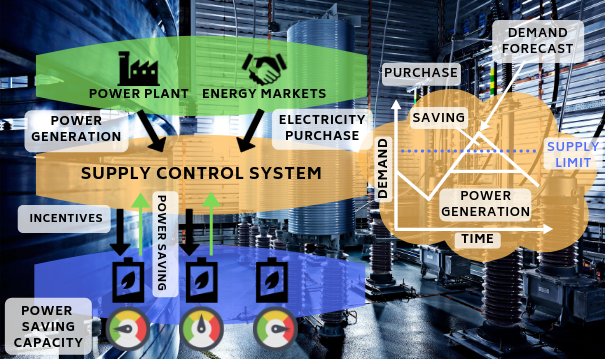

Building new power plants is very costly, and renewable sources like solar and wind are currently difficult to accommodate in conventional utility operations. Adding renewables is getting easier, but there is an interim period when utilities need to be able to provide the increased amount of electricity that their customers are demanding, without breaking the bank.

DR is one of the best ways to do this, and is already established in North America, where air conditioning systems are often wired into a controllable interface that lets the utility signal when to adjust the AC’s load. However, improvements in smart home technology mean that much more functionality can be achieved.

With more precise readings and data available that can be incorporated into operational planning, the utility can better plan capex-heavy investments, like building new power plants, or avoid paying an energy wholesaler for expensive emergency capacity to accommodate a shortfall between demand and supply. The utility can simply request or command that the DR devices reduce their demand, and in exchange, these customers are rewarded with bill credits or rebates.

However, these smart home technologies allow other providers to step into this new market, and become DR providers to the utilities – the 24% of DR homes that were mentioned above. While smart home devices remain popular, with smart thermostats being the flagship device in this regard, there is nothing a utility can do to prevent a home with a smart thermostat independently signing up to a DR program through the device. At scale, these smart home brands can become significant players in the DR services market.

The adoption of RDR is beneficial to the utilities, but brokering the deals with third-parties instead of retaining ownership of this grid-balancing asset is a strategic but necessary loss of influence. To this end, we expect the demand response vendors to become lucrative utility partners, as the utilities seek to leverage these homes in their path to greater renewable energy adoption.

As the adoption of smart home technologies among consumers increases, the ease with which a home can sign up to a demand response program rises. Equipment and device vendors will be able to offer participation as a service to their customers, signing the home up to the local utility’s program with promises of reducing bills, while being able to charge the utilities for this service.

However, software-only approaches have also taken hold, acting as the mediator between a home and the utility for a slice of the action. Some utilities have begun exploring the opportunity of owning the entire relationship, but most are currently pursuing partnerships.