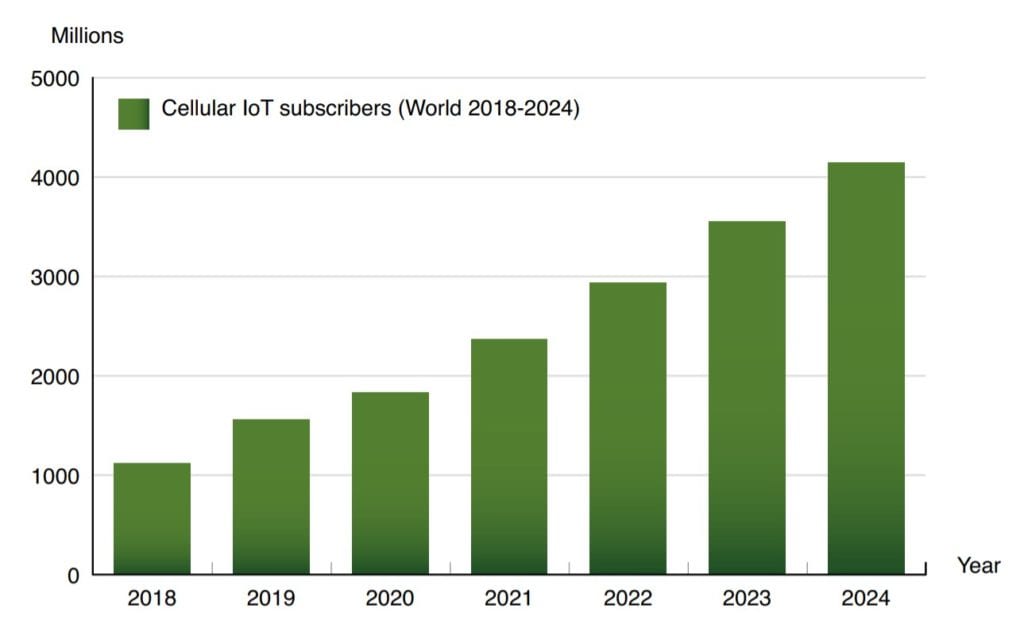

Swedish Berg Insight telecom intelligence estimates that the global number of cellular IoT subscribers increased by 40 percent during 2019 to reach 1.56 billion at the end of the year – corresponding to around 16 percent of all mobile subscribers, according to The Global M2M/IoT Communications Market – 5th Edition Report.

Until 2024, the number of cellular IoT subscribers is forecasted to grow at a compound annual growth rate (CAGR) of 21.6 percent to reach 4.15 billion at the end of the period. During the same period, cellular IoT connectivity revenues are forecasted to grow at a compound annual growth rate (CAGR) of 16.1 percent from € 7.0 billion in 2019 to approximately € 14.8 billion in 2024. Meanwhile the monthly ARPU is expected to drop to € 0.32. Due to the global COVID-19 pandemic, the growth in IoT connections is anticipated to be halved in 2020 compared to the previous year.

China is the world’s largest market for cellular IoT connectivity services by volume

According to data from the national regulator, the installed base grew by 54 percent year-on-year to reach 1.03 billion IoT connections at the end of 2019. This corresponded to two thirds of the global installed base. Berg Insight believes that the role of the Chinese government is the main explanation for why China is ahead of the rest of the world in the adoption of IoT. Authorities actively endorse large-scale IoT deployments as a method for addressing problems affecting the society, whether it is crime, fire safety, energy conservation or traffic management. The private sector is directed and encouraged to do the same.

North America and Western Europe ranks as the second and third largest markets

for IoT solutions with 156 million and 148 million IoT subscribers respectively at the end of 2019. In contrast to China, developments in these regions are largely driven by commercial interests. The connected car is currently one of the strongest trends with more than 60 percent of new cars sold featuring embedded cellular connectivity in the regions. Fleet management, smart metering and asset monitoring comprises other key application areas for cellular IoT. Latin America, South Asia, Southeast Asia and Russia & CIS had installed bases in the range of 22–40 million IoT subscribers each, while Africa, Middle East, Central Eastern Europe, and Australia & Oceania were in the span 8–18 million.

China Mobile is the world’s largest provider of cellular IoT connectivity

At the end of 2019, the operator had an estimated 683 million cellular IoT connections and a year-on-year growth rate of 50 percent. China Unicom and China Telecom ranked second and third with 190 million and 157 million connections respectively. Vodafone ranked first among the Western operators and fourth overall with 97 million connections, followed by AT&T in fifth place with 66 million. Verizon, Deutsche Telekom and Telefónica had in the range 24–46 million cellular IoT connections. Orange and Telenor were the last players in the top ten with 17 million and 16 million connections respectively. Year-on-year growth rates for the mentioned Western operators were in the span 10–30 percent.

IoT connectivity revenues are growing

at a considerably slower rate than the number of connections

Berg Insight’s analysis of the IoT business KPIs released by mobile operators in different parts of the world suggests that global IoT connectivity revenues increased by around 17 percent during 2019, while the monthly ARPU dropped by 23 percent. Excluding China, the trend was less dramatic with revenues growing by 15 percent and ARPU declining 4 percent. Indeed, there is a negative correlation between growth in connections and monthly ARPU as the bulk of net additions are cost sensitive devices. On average, IoT connectivity revenues account for around 1 percent of total revenues for most operator groups. Mobile operators looking to increase IoT revenues increasingly focus on adding cloud services and security capabilities on top of their connectivity offering to capture a larger share of the market.

China Mobile reported the highest IoT connectivity revenues

of € 1.1 billion but had the lowest monthly ARPU of just € 0.13. AT&T does not report IoT connectivity revenues but is believed to have generated approximately € 750–800 million. Annual IoT connectivity revenues for the Vodafone group in its fiscal year ending in March 2020 amounted to € 698 million with a monthly ARPU of € 0.62. Berg Insight estimates that Vodafone’s total IoT revenues derived from the sales of connectivity services and IoT solutions exceeded € 800 million in the year. Verizon generates annual IoT revenues in the range of € 1.5 billion with close to 60 percent coming from the Verizon Connect fleet management and telematics business. China Unicom is the fifth largest global mobile operator by IoT connectivity revenue, reporting € 393 million in IoT sales for the year.